Sunday, May 20, 2012

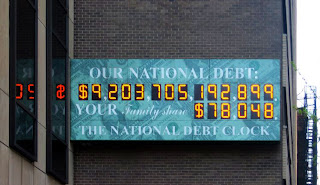

Sovereign Debt Problems – United States or Europe, Who Is Worse Off?

Recently Standard and Poor’s downgraded 9 European Countries including the number two EU member France. For now, it seems the number one EU economy Germany is off the hook. There are six Euro-zone Countries that currently have equal or greater debt to GDP ratios than the United States. Greece and Italy currently have higher GDP ratios while Ireland and Portugal are just about the same as the US. Currently the United States is at 100% Debt to GDP.

A big problem for America is that the financial analysts who do all the reporting on the United States debt and calculate all the financial data, only look at parts of the fiscal equation to render their reports. They mostly only factor in debt where the US borrowed money, where the Federal Government has sold Treasury Bonds. Financial analysts don’t factor in other important government debts or obligations. Such as $6 trillion in loan obligations from Fanny Mae and Freddie Mac, which are guaranteed by the Government. Or over $1 trillion in student loans again guaranteed by the Federal Government. The US is required to pay on these loans in the case of default....

A big problem for America is that the financial analysts who do all the reporting on the United States debt and calculate all the financial data, only look at parts of the fiscal equation to render their reports. They mostly only factor in debt where the US borrowed money, where the Federal Government has sold Treasury Bonds. Financial analysts don’t factor in other important government debts or obligations. Such as $6 trillion in loan obligations from Fanny Mae and Freddie Mac, which are guaranteed by the Government. Or over $1 trillion in student loans again guaranteed by the Federal Government. The US is required to pay on these loans in the case of default....

Subscribe to:

Post Comments (Atom)

About Me

- Unknown

Join Our Newsletter

Subscribe to our Free Newsletter, fill out the form below. Watch for our weekly newsletter updates.

Our strict privacy policy keeps your email address 100% safe & secure.

Powered by Blogger.

0 comments:

Post a Comment