Showing posts with label reserve currency. Show all posts

Showing posts with label reserve currency. Show all posts

Saturday, June 1, 2013

The Path of Gold – Where it’s Been, Where it’s Headed!

All of the gold held by central banks throughout the west, originally, was owned by the people. Slowly this gold has been siphoned away from the people by the central bankers through inflation. However now, even these giant banks in the west are losing their gold as it slowly is being transferred to the east.

The gold stored in these central banks was at one time used to back all western currencies. However the sole purpose for gold being held in western banks today is for repayment of debt. History shows us that approximately every 30 to 40 years the world creates a new monetary system. Previous monetary systems continually have failed due to poor fiscal policy, planning and manipulations. Before WWI most countries kept a specific amount of gold in their treasuries. The treasuries would then issue out currency notes into circulation in amounts that equaled the equivalent value of…

Sunday, May 19, 2013

American Debt and Its Consequences

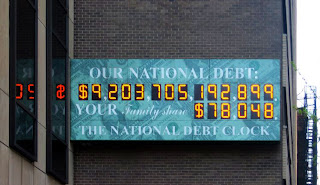

The US dollar being the world’s reserve currency where other central banks have taken comfort for decades, now is fundamentally broke. The world’s reserve currency is now broke because of the accumulated American debt that can no longer be controlled.

The US dollar being the world’s reserve currency where other central banks have taken comfort for decades, now is fundamentally broke. The world’s reserve currency is now broke because of the accumulated American debt that can no longer be controlled.These days the politicians elected into government and tasked with responsible policy making, don't have the political will do right thing. They refuse to turn things around, to stop the slow train wreck that's approaching. Some believe this slow train wreck will arrive sometime around 2015. This train has been built upon the tracks of circumstance, with decisions that were created re-actively, thus now it's running out of control…

Sunday, May 5, 2013

Gold - Heads Toward Tier I Asset Status

World-wide monetary systems have been built upon the model of the United States dollar. While currently the dollar is still the world’s reserve currency its status as such, could be held into question over the Basel III talks with America. It is widely expected that the US will lead the way in further developments towards gold’s rise to Tier I status.

World-wide monetary systems have been built upon the model of the United States dollar. While currently the dollar is still the world’s reserve currency its status as such, could be held into question over the Basel III talks with America. It is widely expected that the US will lead the way in further developments towards gold’s rise to Tier I status.Within developed countries of the world, the unified consensus is that gold has yet to show any real signs of true-value towards the 41 year old paper currency fiat money system. The system now is starting to break down. Over the past 5 years serious strain and stress has occurred within the current dollar fiat system. Intensifying signs show problematic developments, now and into the future. These developments could be a sign where the current fiat based system is too flawed. This makes a good argument where gold held in reserves would be necessary to increase liquidity, thus granting easier access to loans of nations in need.

Saturday, March 9, 2013

Monetary Systems & The World’s Reserve Currency

By studying history, it is possible to learn how past civilizations have risen and fallen. Repeated mistakes have been made throughout time. These mistakes show us how monetary systems within societies have broken down and collapsed since money was first used.

By studying history, it is possible to learn how past civilizations have risen and fallen. Repeated mistakes have been made throughout time. These mistakes show us how monetary systems within societies have broken down and collapsed since money was first used.The Past –

History can show us many things; let’s take the rise and fall of the Roman Empire. The Romans rose to power in 64 AD. by starting out on a solid financial footing. There was a sound money system in place. They started off using 100 percent solid gold and silver coins as a medium of exchange for goods and services. As time passed however, more and more social programs needed funding. More major government projects were taken on, along with more and more wars being fought…

Saturday, December 15, 2012

Worlds Reserve Currency, The Dollar Threatened!

The US dollar once again is under attack as the world’s reserve currency. Late December of last year the world’s second and third largest economies Japan and China held important discussions, coming to an agreement for opening up currency swap lines between the two countries.

Swap Lines

The Prime Minister of Japan Yoshihiko Noda and the Premier of China Wen Jianbao agreed to conduct bilateral trade. The agreement to open currency swap lines between the two currencies will also be forgoing the use of the dollar for trading in the future. The two countries have a long history in the past of not being able to agree mutually on foreign policy decisions or economic issues. However this time around they both agreed that trading between the two…

Swap Lines

The Prime Minister of Japan Yoshihiko Noda and the Premier of China Wen Jianbao agreed to conduct bilateral trade. The agreement to open currency swap lines between the two currencies will also be forgoing the use of the dollar for trading in the future. The two countries have a long history in the past of not being able to agree mutually on foreign policy decisions or economic issues. However this time around they both agreed that trading between the two…

Saturday, December 8, 2012

US Dollar Existence - Threatened by Game Changing Events

Recent events have occurred that put at risk the existence of the US dollar and all other fiat currencies. There are two main gold depositories in the world that hold or have held most of the world’s bullion for the countries that don’t hold their own. They are the Bank of England and the Federal Reserve Bank of New York.

The first event occurred in early 2011 when Venezuela’s President Hugo Chavez announced that Venezuela was taking back all the country’s gold bullion held at the Bank of England. While announcing this, construction was already underway to construct vaults at home for storing Venezuela’s 200 plus tons of bullion…

The first event occurred in early 2011 when Venezuela’s President Hugo Chavez announced that Venezuela was taking back all the country’s gold bullion held at the Bank of England. While announcing this, construction was already underway to construct vaults at home for storing Venezuela’s 200 plus tons of bullion…

Saturday, June 16, 2012

The History Of Money

In the earliest of times trading and bartering were used in the exchange of goods and services. The trading of such items as herd animals, sea shells, salt, tobacco, gold, gemstones and other similar items were commonly used by man before actual currency was invented.

In the earliest of times trading and bartering were used in the exchange of goods and services. The trading of such items as herd animals, sea shells, salt, tobacco, gold, gemstones and other similar items were commonly used by man before actual currency was invented.Currency – The Beginning

The first currency ever used, was in coin form and dates back to 600 B.C. by then King Croesus of Lydia in Asia Minor. At that time Lydia was located in what is now present day Turkey. These coins were minted from a naturally occurring alloy of gold and silver called electrum. And each coin had a specific weight of 4.7 grams. These coins functioned as a medium of exchange, unit of payment and were capable of preserving value...

Sunday, May 20, 2012

Sovereign Debt Problems – United States or Europe, Who Is Worse Off?

Recently Standard and Poor’s downgraded 9 European Countries including the number two EU member France. For now, it seems the number one EU economy Germany is off the hook. There are six Euro-zone Countries that currently have equal or greater debt to GDP ratios than the United States. Greece and Italy currently have higher GDP ratios while Ireland and Portugal are just about the same as the US. Currently the United States is at 100% Debt to GDP.

A big problem for America is that the financial analysts who do all the reporting on the United States debt and calculate all the financial data, only look at parts of the fiscal equation to render their reports. They mostly only factor in debt where the US borrowed money, where the Federal Government has sold Treasury Bonds. Financial analysts don’t factor in other important government debts or obligations. Such as $6 trillion in loan obligations from Fanny Mae and Freddie Mac, which are guaranteed by the Government. Or over $1 trillion in student loans again guaranteed by the Federal Government. The US is required to pay on these loans in the case of default....

A big problem for America is that the financial analysts who do all the reporting on the United States debt and calculate all the financial data, only look at parts of the fiscal equation to render their reports. They mostly only factor in debt where the US borrowed money, where the Federal Government has sold Treasury Bonds. Financial analysts don’t factor in other important government debts or obligations. Such as $6 trillion in loan obligations from Fanny Mae and Freddie Mac, which are guaranteed by the Government. Or over $1 trillion in student loans again guaranteed by the Federal Government. The US is required to pay on these loans in the case of default....

Sunday, April 29, 2012

Euro Zone Crisis – Will It Destroy The US Dollar?

The economic conditions in Europe are becoming worse as the weeks move on. In all, there’s at least a fifty percent stake involving US banks that are exposed to some degree with European debt problems within the Euro-zone. Furthermore, it is the US dollar that still remains the world’s reserve currency. And the Federal Reserve, whose status remains none other than the “lender of last resort” thus, making it very hazardous for the US taxpayers.

The huge US Government bailout program from 2008 only helped the large banks, auto industry and giant institutions such as AIG and several foreign central banks from going under. Because they were all deemed “to big to fail” at the end of the day however, nothing was solved and the bailouts amounted to nothing. These mega banks and companies only lined their own greedy corporate pockets and left the American taxpayers holding the bag...

The huge US Government bailout program from 2008 only helped the large banks, auto industry and giant institutions such as AIG and several foreign central banks from going under. Because they were all deemed “to big to fail” at the end of the day however, nothing was solved and the bailouts amounted to nothing. These mega banks and companies only lined their own greedy corporate pockets and left the American taxpayers holding the bag...

Saturday, March 17, 2012

The Truth Be Told About The Dollar And Gold

I’m here today to share a secret that I exposed, which seems to keep missing out on the nightly news broadcasts. I don’t know why this information has not been at the center of media attention but it should have been in mainstream news several years ago.

For a quite a while now lots of attention has been given in the media regarding the higher costs of living such new state taxes, staple consumer goods, fuel etc. Also for those paying attention you will have seen and heard lot s of information in the news on increasing gold prices. Main stream media has been covering the economy saying all the while it is improving.

However all one needs to do is open their eyes and look to see that many businesses are struggling and shutting down. Is this improvement? We can listen to people telling how they don't have any savings left or money anymore. It’s only obvious the US Economy is getting worse. The value of the US Dollar which has also solely been used as the world’s reserve currency is faltering. Consequently most world currencies are failing along with it. Question: Why is all this happening? What can anyone do?...

For a quite a while now lots of attention has been given in the media regarding the higher costs of living such new state taxes, staple consumer goods, fuel etc. Also for those paying attention you will have seen and heard lot s of information in the news on increasing gold prices. Main stream media has been covering the economy saying all the while it is improving.

However all one needs to do is open their eyes and look to see that many businesses are struggling and shutting down. Is this improvement? We can listen to people telling how they don't have any savings left or money anymore. It’s only obvious the US Economy is getting worse. The value of the US Dollar which has also solely been used as the world’s reserve currency is faltering. Consequently most world currencies are failing along with it. Question: Why is all this happening? What can anyone do?...

Subscribe to:

Posts (Atom)

About Me

- Unknown

Join Our Newsletter

Subscribe to our Free Newsletter, fill out the form below. Watch for our weekly newsletter updates.

Our strict privacy policy keeps your email address 100% safe & secure.

Powered by Blogger.