Saturday, December 29, 2012

Earth’s Silver Supply - Much More Limited Than Gold

The dynamics of the current precious metals bull market today is totally different than the previous bull market of the 1980’s. This time around the bull market has gone global.

During the early 1980’s who were the people responsible for driving up gold’s price to $850.00 and silver’s price to $50.00? During this time the only real players in these markets were North America and Western Europe. Both U.S.S.R. and Eastern Europe at that time had very unstable economies therefore it was pretty much impossible for any of their citizens to participate in purchasing any precious metal for investment.

Furthermore China, India, South America and Mexico being for the most part, farming countries had no wealth amongst their citizens to buy precious metals either. Even if there were people around lucky enough to have some money for investing there were no exchanges around in those days for any trading to take place…

During the early 1980’s who were the people responsible for driving up gold’s price to $850.00 and silver’s price to $50.00? During this time the only real players in these markets were North America and Western Europe. Both U.S.S.R. and Eastern Europe at that time had very unstable economies therefore it was pretty much impossible for any of their citizens to participate in purchasing any precious metal for investment.

Furthermore China, India, South America and Mexico being for the most part, farming countries had no wealth amongst their citizens to buy precious metals either. Even if there were people around lucky enough to have some money for investing there were no exchanges around in those days for any trading to take place…

Saturday, December 22, 2012

Gold Price $3,500 To $5,000 – Within 1-1/2 Years

Currently every country in Europe with little exception is burning. Don’t be mistaken, the United States is not far off from this internal flame either. It is going to take some type of large scale Central Banking coordinated event to trigger the large scale money-printing that will ultimately need to happen.

Money printing from the world’s central banks will all need to come together as one, to prevent the major economies of the world from imploding. Events such as high unemployment world-wide could be a trigger to set off the printing presses…

Money printing from the world’s central banks will all need to come together as one, to prevent the major economies of the world from imploding. Events such as high unemployment world-wide could be a trigger to set off the printing presses…

Saturday, December 15, 2012

Worlds Reserve Currency, The Dollar Threatened!

The US dollar once again is under attack as the world’s reserve currency. Late December of last year the world’s second and third largest economies Japan and China held important discussions, coming to an agreement for opening up currency swap lines between the two countries.

Swap Lines

The Prime Minister of Japan Yoshihiko Noda and the Premier of China Wen Jianbao agreed to conduct bilateral trade. The agreement to open currency swap lines between the two currencies will also be forgoing the use of the dollar for trading in the future. The two countries have a long history in the past of not being able to agree mutually on foreign policy decisions or economic issues. However this time around they both agreed that trading between the two…

Swap Lines

The Prime Minister of Japan Yoshihiko Noda and the Premier of China Wen Jianbao agreed to conduct bilateral trade. The agreement to open currency swap lines between the two currencies will also be forgoing the use of the dollar for trading in the future. The two countries have a long history in the past of not being able to agree mutually on foreign policy decisions or economic issues. However this time around they both agreed that trading between the two…

Saturday, December 8, 2012

US Dollar Existence - Threatened by Game Changing Events

Recent events have occurred that put at risk the existence of the US dollar and all other fiat currencies. There are two main gold depositories in the world that hold or have held most of the world’s bullion for the countries that don’t hold their own. They are the Bank of England and the Federal Reserve Bank of New York.

The first event occurred in early 2011 when Venezuela’s President Hugo Chavez announced that Venezuela was taking back all the country’s gold bullion held at the Bank of England. While announcing this, construction was already underway to construct vaults at home for storing Venezuela’s 200 plus tons of bullion…

The first event occurred in early 2011 when Venezuela’s President Hugo Chavez announced that Venezuela was taking back all the country’s gold bullion held at the Bank of England. While announcing this, construction was already underway to construct vaults at home for storing Venezuela’s 200 plus tons of bullion…

Saturday, December 1, 2012

Hyperinflation – Being Prepared, the Logical Steps to Take

Hyperinflation is a severe economic event that spreads both physical and monetary devastation throughout entire countries. Throughout history the after effects from these massive economic events have seen whole societies crumble to the ground. I would like to go over several specific steps in which you and your family can prepare for a major economic event such as hyperinflation. We will learn ways of preparedness and how to make preparations that will either prevent or limit the amount physical and financial damage that could possibly come your way, once the economy finally collapses.

The key to your survival is taking action now and preparing in advance, before an economic crisis comes. Once it arrives, if you’re not prepared, then you and your family are going to seriously suffer. Preparedness is all up to you. Do not expect any local or national governments to help you. Currently these governments cannot even help themselves and are the root causes for why the stage is currently being set for hyperinflation in the first place. Let’s go over these logical steps and learn how to best protect you and your loved ones…

The key to your survival is taking action now and preparing in advance, before an economic crisis comes. Once it arrives, if you’re not prepared, then you and your family are going to seriously suffer. Preparedness is all up to you. Do not expect any local or national governments to help you. Currently these governments cannot even help themselves and are the root causes for why the stage is currently being set for hyperinflation in the first place. Let’s go over these logical steps and learn how to best protect you and your loved ones…

Saturday, November 24, 2012

Economic Crisis, Personal and Home Defense – Lethal Weapons

On December 31 2011 President Obama signed into law the new 2012 National Defense Authorization Act. During times of a severe economic crisis anyone can be held indefinitely without being charged of a crime. This is to control and maintain public order. You’re First Amendment rights are being stripped away of legal representation and judicial process. The US Military now has full throttle control of your individual freedoms or rights as a citizen of the United States.

The enactment of the National Defense Authorization Act enables full military policing upon the citizens of the United States. Sadly turning American into one huge police state. During times of a severe economic downturn such as hyperinflation protecting your family and your home are still guaranteed by the 5th Amendment or The Right to Bear Arms. The use of lethal weapons can be the last line of defense in protecting your family from the threat of people who might harm you or get into your food storage and other vital supplies. Your family must maintain these supplies to survive the hardest of times ahead. A threat to your supplies is a direct threat to your family’s existence.

I am going to be covering what types of weapons would be ideal to use in home and personal defense…

The enactment of the National Defense Authorization Act enables full military policing upon the citizens of the United States. Sadly turning American into one huge police state. During times of a severe economic downturn such as hyperinflation protecting your family and your home are still guaranteed by the 5th Amendment or The Right to Bear Arms. The use of lethal weapons can be the last line of defense in protecting your family from the threat of people who might harm you or get into your food storage and other vital supplies. Your family must maintain these supplies to survive the hardest of times ahead. A threat to your supplies is a direct threat to your family’s existence.

I am going to be covering what types of weapons would be ideal to use in home and personal defense…

Saturday, November 17, 2012

Economic Crisis, Personal and Home Defense – Non Lethal

America is facing a crisis of epic proportions; the threat of an all-out economic collapse is very real. People should be concerned more these days about personal and home safety with so much of the population either jobless or under-employed. In these desperate times people are stealing food and basic necessities from stores, houses or wherever an opportunity arises.

As economic conditions worsen inside the United States expect crime rates such as physical assaults and theft to increase. Everyone should have some form of personal protection to deter a would-be assailant from harming you, your family or your property.

Major areas that need to be secured within your home would be emergency food storage and equipment, which will carry your family through the hardest of times once the economy finally collapses. Should anyone suspect or learn that you have a stash; it will become a prime target for…

As economic conditions worsen inside the United States expect crime rates such as physical assaults and theft to increase. Everyone should have some form of personal protection to deter a would-be assailant from harming you, your family or your property.

Major areas that need to be secured within your home would be emergency food storage and equipment, which will carry your family through the hardest of times once the economy finally collapses. Should anyone suspect or learn that you have a stash; it will become a prime target for…

Sunday, November 11, 2012

Hyperinflation Preparedness – Water Storage And Purification

Even more important for human survival then food, which is number two is fresh drinking water. For your storage it is vital you have water enough to last for a while. If you have a natural clean source of water nearby and can insure you have access to it that is great. Many will not be as lucky. Bottled water can be stored. One person should consume a minimum of two liters of drinking water per day. A minimum one month supply of fresh drinking water should be stored per person if possible.

Water will take up a lot of your storage space, keeping it in small 1 gallon plastic bottles would be expensive if store bought. Another better and cheaper solution is to have a number of 30 or 55 gallon plastic sealed drums with bung holes and tight fitting screw on bung caps that have been cleaned out with a water/bleach solution. Fill each drum with…

Water will take up a lot of your storage space, keeping it in small 1 gallon plastic bottles would be expensive if store bought. Another better and cheaper solution is to have a number of 30 or 55 gallon plastic sealed drums with bung holes and tight fitting screw on bung caps that have been cleaned out with a water/bleach solution. Fill each drum with…

Sunday, November 4, 2012

Food Storage for Hyperinflation

Once hyperinflation occurs food is going to skyrocket in price and become scarce to find. You must have food and fresh drinking water to survive. You should create at minimum a six month emergency supply of food for your family before such an economic crisis hits America or Europe. Your food supply needs to be stored in a safe environment so it will get your family through the hard times destined to come. Below explained in detail is an emergency preparedness plan with an option for food storage. This will allow you to get started setting everything up for your family right now.

Plan Ahead, Set Up Your Own Food Storage while you have time. Today were going to concentrate on the initial steps you and your family will need in preparing your personal Emergency Preparedness Supplies. The first part of any survival plan will be…

Plan Ahead, Set Up Your Own Food Storage while you have time. Today were going to concentrate on the initial steps you and your family will need in preparing your personal Emergency Preparedness Supplies. The first part of any survival plan will be…

Sunday, October 28, 2012

America - Paving Its Way Towards Hyperinflation

The United States could very well be on the path towards a deflationary collapse, far worse than America experienced during the Great Depression in the 1930’s. However arguably, the likely outcome is going to be even worse. The US is currently on the rails and headed right for hyperinflation and the destruction of the dollar. Overwhelming evidence has been abundant, America has known for a long time this problem exists. Yet the US Government and Federal Reserve have yet to come up with any viable solutions to fix it.

All current indications are pointing to Hyperinflation in the United States, and destruction of the dollar sometime within…

All current indications are pointing to Hyperinflation in the United States, and destruction of the dollar sometime within…

Saturday, October 20, 2012

The Twenty First Century – Gold And Silver Bull Market

The world is currently in the middle of this century’s biggest bull market to date. Unlike the last great bull market for gold and silver in the 1970’s, this time, investors from the four corners of the world will have a chance to take part in the investment opportunity of a lifetime.

During the last great gold rush in the late 1970’s, only investors from the United States and the better part of Western Europe were able to participate. That was because back then, most other nations did not allow physical ownership of gold as it was either illegal to own, not available for investment or not in public demand. Many of the world’s countries including Russia, Eastern Europe, China and India, as well as all other Asian nations, South America and Mexico were incapable of …

During the last great gold rush in the late 1970’s, only investors from the United States and the better part of Western Europe were able to participate. That was because back then, most other nations did not allow physical ownership of gold as it was either illegal to own, not available for investment or not in public demand. Many of the world’s countries including Russia, Eastern Europe, China and India, as well as all other Asian nations, South America and Mexico were incapable of …

Sunday, October 14, 2012

Why Gold and Silver Are Still A Major Bargain

The majority of the world is in dire financial straits; economies cannot get a grip on their expanding debt and are using deficit spending to no end. The entire system is un-sustainable and economies are going to collapse. At this point in time surely before the end of this decade if not sooner, the greatest wealth transfer in history will take place. That also means the greatest time for opportunity, is to react now.

Obtaining physical gold and silver and keeping it outside of the banking systems, becomes the greatest form of wealth protection for your assets. Assuring you against either a deflationary collapse or hyperinflationary destruction of paper currency. These precious metals are absolutely vital to your financial survival. Below are several facts necessary to understand first, so you will know why precious metals are still very much undervalued…

Obtaining physical gold and silver and keeping it outside of the banking systems, becomes the greatest form of wealth protection for your assets. Assuring you against either a deflationary collapse or hyperinflationary destruction of paper currency. These precious metals are absolutely vital to your financial survival. Below are several facts necessary to understand first, so you will know why precious metals are still very much undervalued…

Sunday, October 7, 2012

Currency Creation - How Is It Actually Created?

Real money also referred to as “sound money” is made up of hard assets such as gold and silver. This form of sound money starts in the ground where it is first dug up. Then it goes through processing and refinement and finally it becomes money once the refined gold or silver has been minted into coins by a government treasury. However in this day and age it is not sound money that circulates globally within each country it is another form of money known as “fiat currency”. All fiat currencies are the same but how…

Saturday, September 29, 2012

Could There Be A Chance For A One World Currency?

Would the world be a better place if it were able to share the same currency? Would it benefit the masses? Honestly, that answer has to be no. The chances of the entire world using the same currency will never have a chance to exist, let’s understand why.

The utmost important factor in argument against sharing a world-wide common monetary unit regardless what that monetary unit might be called, hinges upon one common and certain fact. The loss of each country’s ability to wage war. To begin, all countries would have to be losing their economies at the same time. And from this point forward if a common currency were put into place, each country would lose the ability to create war upon another nation…

The utmost important factor in argument against sharing a world-wide common monetary unit regardless what that monetary unit might be called, hinges upon one common and certain fact. The loss of each country’s ability to wage war. To begin, all countries would have to be losing their economies at the same time. And from this point forward if a common currency were put into place, each country would lose the ability to create war upon another nation…

Sunday, September 23, 2012

Inflation – Its Effects Created Upon A Society

Defining inflation is the slow and on-going price increase of commodities, goods and services observed over a long period of time that reflects rising annual costs for manufactures and consumers. Inflation can be created using two different scenarios. On one hand we can use the quality theory of inflation to determine how inflation is created. On the other hand we can use the quantity theory of inflation to explain it.

To explain the quality theory of inflation we see it as founded upon the belief that a currency being used is acceptable and capable of being traded for goods and services, but also is beneficial to the buyer. However explaining how the quantity theory of inflation works is associated to the aspect of currency. This theory actually takes into account the currency’s supply and demand aspects as well as its nominal value of exchange.

Inflation will create many effects upon an economy both good and bad…

To explain the quality theory of inflation we see it as founded upon the belief that a currency being used is acceptable and capable of being traded for goods and services, but also is beneficial to the buyer. However explaining how the quantity theory of inflation works is associated to the aspect of currency. This theory actually takes into account the currency’s supply and demand aspects as well as its nominal value of exchange.

Inflation will create many effects upon an economy both good and bad…

Labels:

actual value,

commodities,

debt,

economy,

high inflation,

high prices,

hyperinflation,

inflation,

net loss,

society,

true value

|

0

comments

Sunday, September 16, 2012

Sound Money - Can Change Governments

Sound money should be the only acceptable means of payment or credit used during these insane times when all major countries are fighting to survive with “record setting” government debts. Governments must all revert back to a sound money system to regain fiscal control over their spending habits or face losing everything.

Money – The Beginning

In the distant past, man used bartering and trading as acceptable forms of payment for goods and services. Many items traded included sea shells, salt, tobacco, herd animals, beaded belts, gem stones and gold. This worked well at the time, however there needed to be a better more convenient way to make transactions.

Coins became the first answer to make the exchange of goods and services more convenient. In 600 B.C. the first minted coins appeared, they were minted from an alloy called electrum. This was a combination of gold and silver. Each coin had a specific weight of 4.7 grams and acted as a medium of exchange, division of payment and was also capable of maintaining its value. From the time coins were first minted they gained popularity becoming the best form of money all the way into modern times.

What is Sound Money

In 400 B.C. Aristotle defined what sound money was and what characteristics were necessary to insure sound money. He said that sound money must incorporate all 7 of the following properties…

Money – The Beginning

In the distant past, man used bartering and trading as acceptable forms of payment for goods and services. Many items traded included sea shells, salt, tobacco, herd animals, beaded belts, gem stones and gold. This worked well at the time, however there needed to be a better more convenient way to make transactions.

Coins became the first answer to make the exchange of goods and services more convenient. In 600 B.C. the first minted coins appeared, they were minted from an alloy called electrum. This was a combination of gold and silver. Each coin had a specific weight of 4.7 grams and acted as a medium of exchange, division of payment and was also capable of maintaining its value. From the time coins were first minted they gained popularity becoming the best form of money all the way into modern times.

What is Sound Money

In 400 B.C. Aristotle defined what sound money was and what characteristics were necessary to insure sound money. He said that sound money must incorporate all 7 of the following properties…

Saturday, September 8, 2012

Inflation, Central Banks Control & The Cure!

Inflation is a serious problem that will affect any society overtime. Serious monetary stresses are created that will affect the most basic of needs such as food for your family to eat, fuel for your car or medicine to keep you alive. Inflation makes the prices you pay increase on the exact same products or services you were buying or using before. Most people will realize these price increases as they reflect on what these items had cost them only 1-2 years ago. Why?

Inflation is created by directly increasing the money supply in an economy. When this happens it creates a watering down affect on the money supply. If you take newly created dollars and add them to the economies money supply, along with all the other dollars that were already there, we get the total money supply…

Inflation is created by directly increasing the money supply in an economy. When this happens it creates a watering down affect on the money supply. If you take newly created dollars and add them to the economies money supply, along with all the other dollars that were already there, we get the total money supply…

Sunday, September 2, 2012

The Federal Reserve Bank – What is it Really?

The Federal Reserve is one of the largest problems facing America today. The one question many people ask is what does a Federal Government Bank have to do with our nation's problems? For starters it is Federal in name only.

The Federal Reserve Bank is not part of the US Government. It is actually a privately owned corporation and international bank that was created by Congress in 1913. The passage of the 16th amendment was passed rather shadily, and according to some, illegally. Furthermore it was given the exclusive rights to "print money" for the U.S. Government by Congress, during the Christmas break in 1913 when most of the representatives were on vacation.

Before the creation of the Federal Reserve the power and responsibility to print our nation’s money was done by the Congress of the United States. Sadly since the time when the Federal Reserve was given the power to operate the printing press, the people of America have continually been charged interest on every dollar ever printed…

The Federal Reserve Bank is not part of the US Government. It is actually a privately owned corporation and international bank that was created by Congress in 1913. The passage of the 16th amendment was passed rather shadily, and according to some, illegally. Furthermore it was given the exclusive rights to "print money" for the U.S. Government by Congress, during the Christmas break in 1913 when most of the representatives were on vacation.

Before the creation of the Federal Reserve the power and responsibility to print our nation’s money was done by the Congress of the United States. Sadly since the time when the Federal Reserve was given the power to operate the printing press, the people of America have continually been charged interest on every dollar ever printed…

Sunday, August 26, 2012

History of Money - The Missing Subject, You Never Learned in School

Like many others, I was educated in the US public school system. It seems however, one very important subject had never purposely been taught in our schools. That subject being the history of money and attainment of wealth.

The biggest reason public educators never approached this subject was that monetary history was taught privately and only to the elite one percent of the world’s society. Meaning only the ultra rich were privy to this closely guarded information. The other 99% of us were basically “shit out of luck”. Monetary history and wealth generation were spoon fed to the elite one percent. Once they entered society they used this valuable information strictly to their advantage, allowing them to earn 90% of the total wealth generated on the planet…

The biggest reason public educators never approached this subject was that monetary history was taught privately and only to the elite one percent of the world’s society. Meaning only the ultra rich were privy to this closely guarded information. The other 99% of us were basically “shit out of luck”. Monetary history and wealth generation were spoon fed to the elite one percent. Once they entered society they used this valuable information strictly to their advantage, allowing them to earn 90% of the total wealth generated on the planet…

Saturday, August 18, 2012

Gold Bullion Investing - Protect Your Wealth

There are two schools of thought as to why gold has been rising and catching the interest of hedge funds and investors alike. First, interest rates that have been at negative levels. Secondly, gold that maintains its true value over fiat currency. The faster fiat currency is produced, i.e. US dollars, euros, British pounds or the Japanese yen, the faster and deeper deflation will set in.

We are currently living in very unstable, faltering, unprecedented times. The continuous uprisings and unrest in Greece over currency devaluation have motivated and created fear. It’s expected that people will again turn towards the one thing that has stood the test of time, an element, which will not only to increase their wealth but also to protect it.

Analysts suggest a state of deflation which will cause a double dip recession to form within the months to come…

We are currently living in very unstable, faltering, unprecedented times. The continuous uprisings and unrest in Greece over currency devaluation have motivated and created fear. It’s expected that people will again turn towards the one thing that has stood the test of time, an element, which will not only to increase their wealth but also to protect it.

Analysts suggest a state of deflation which will cause a double dip recession to form within the months to come…

Labels:

bullion,

deflation,

fiat currency,

gold,

gold bullion,

hedging,

wealth,

wealth protection

|

0

comments

Sunday, August 12, 2012

Failed Fiat Currencies In American History

America has had a history of fiat currencies dating back as far as the American Revolution. Even before America’s colonists won their independence from the British. It was in 1775 that the Continental Congress attempted creating its first fiat currency, the Continental.

During the early days of the Revolutionary War the American colonists were having serious trouble financing the revolution. Efforts to acquire additional money from England were slow at best. Furthermore the Continental Congress was forbidden to directly tax the colonists for war funding efforts. A solution for this immediate problem was finally created. The answer was to issue paper currency or bills of credit. This new money was called “Continental Currency” nicknamed Continentals, which became America’s first attempt at the use of fiat currency in the new America. At the time there were many congressmen who realized that over issuing paper currency was just a hidden form of taxation…

During the early days of the Revolutionary War the American colonists were having serious trouble financing the revolution. Efforts to acquire additional money from England were slow at best. Furthermore the Continental Congress was forbidden to directly tax the colonists for war funding efforts. A solution for this immediate problem was finally created. The answer was to issue paper currency or bills of credit. This new money was called “Continental Currency” nicknamed Continentals, which became America’s first attempt at the use of fiat currency in the new America. At the time there were many congressmen who realized that over issuing paper currency was just a hidden form of taxation…

Saturday, August 4, 2012

Hyperinflation, Monetary Collapse of the Financial System - Be Prepared!

For decades now, the world has been partying wildly, while drinking from the proverbial punch bowl of good times. Ever since the gold window was closed by President Nixon in 1971 governments have increasingly relied upon deficit spending and avoided any real attempts to pay it back. As the saying goes “sooner or later you have to pay the piper”. Sadly, the only forms of payment that have ever been paid towards all of these national debts, has been with fiat currency. In essence, more borrowed money.

The politicians want your votes and they want to keep their cushy jobs full of perks for an eternity. The only way they can guarantee their own job security is to promise the populous everything and constantly go on a deficit spending spree to pay for it. If you’re happy, they remain in their cushy jobs and the cycle just keeps repeating each election year. The Fed is obligated to the politicians; they insure an unlimited supply of fiat currency is available for the politicians to fund all the government programs and handouts…

The politicians want your votes and they want to keep their cushy jobs full of perks for an eternity. The only way they can guarantee their own job security is to promise the populous everything and constantly go on a deficit spending spree to pay for it. If you’re happy, they remain in their cushy jobs and the cycle just keeps repeating each election year. The Fed is obligated to the politicians; they insure an unlimited supply of fiat currency is available for the politicians to fund all the government programs and handouts…

Sunday, July 29, 2012

The Weimar Hyperinflation - Could it Happen Again?

At the end of WWI Weimar Germany was suffering from rising inflation, which was starting to get out of control. During a two year period from 1921 through 1923 Inflation was running away. During the time, nearing the end of 1923 Weimar Germany would forever be remembered as a place where one of the greatest hyperinflationary events in history took place. When hyperinflation finally took hold of Germany during this time, its devastating grasp wiped out the entire Weimar Society.

These are times where iconic photos taken of the time can be seen in history books. Photos such as a man using his German marks as “wall paper” or of people trying to buy a single loaf of bread while pushing a wheel barrel full of cash around just to pay for it. Another iconic photo of a woman burning her German marks in a woodstove just to keep the bitter cold away. At that time the money was worthless, burning money was cheaper than burning wood to use as fuel for heat. The hyperinflation was so terrible that on November 1st in 1923 at the height of the crisis 1 pound of bread cost 3 billion German marks while a glass of beer cost 4 billion and a pound of meat cost an incredible 36 billion marks.

As the Weimar example shows their devastation and suffering, this could become an economic event to reach America soon enough. Can the United States actually fall into a Weimar Style Hyperinflation?

These are times where iconic photos taken of the time can be seen in history books. Photos such as a man using his German marks as “wall paper” or of people trying to buy a single loaf of bread while pushing a wheel barrel full of cash around just to pay for it. Another iconic photo of a woman burning her German marks in a woodstove just to keep the bitter cold away. At that time the money was worthless, burning money was cheaper than burning wood to use as fuel for heat. The hyperinflation was so terrible that on November 1st in 1923 at the height of the crisis 1 pound of bread cost 3 billion German marks while a glass of beer cost 4 billion and a pound of meat cost an incredible 36 billion marks.

As the Weimar example shows their devastation and suffering, this could become an economic event to reach America soon enough. Can the United States actually fall into a Weimar Style Hyperinflation?

Sunday, July 22, 2012

Gold Bullion Investing - Protect Your Wealth

Theirs two schools of thought as to why gold has been rising and catching the interest of hedge funds and investors alike. Interest rates that have been at negative levels. As well as gold that maintains its true value over fiat currency. The faster fiat currency is produced (i.e. US. Dollars, Euros, British Pounds and Japanese Yen etc) the faster and deeper deflation will set in.

Were now living in unstable faltering times which are unprecedented. The uprisings and unrest in Greece over currency devaluation has motivated and created fear. It’s expected that people will turn towards the one item which has stood the test of time, not only to increase their wealth but also to protect it…

Were now living in unstable faltering times which are unprecedented. The uprisings and unrest in Greece over currency devaluation has motivated and created fear. It’s expected that people will turn towards the one item which has stood the test of time, not only to increase their wealth but also to protect it…

Labels:

bullion,

deflation,

fiat currency,

gold,

gold bullion,

wealth

|

0

comments

Saturday, July 14, 2012

Storage Options - For Your Precious Metals

Lately, many people in the world have been closely watching and reading the news reports concerning the current global economic situation. The European and American debt situation is now going out of control. It’s fueled by all the governments involved, constant deficit spending habits and lack of will to pay the money back. The Central Banks answer, simply to print more and more money. Many people these days are concerned and have decided to preserve their wealth by purchasing physical precious metals such as gold and silver in either coin or bullion form. These people however also will need a safe and secure place to store their precious metals.

Keeping your silver and or gold precious metals safe from theft will of course be the most important reason for obtaining secured storage when you’re buying precious metal. Let’s review what storage options for physical precious metals are available in detail...

Keeping your silver and or gold precious metals safe from theft will of course be the most important reason for obtaining secured storage when you’re buying precious metal. Let’s review what storage options for physical precious metals are available in detail...

Saturday, July 7, 2012

Inflation and the Dollar Crisis

The rate of inflation in the United States has been steadily rising. The inflationary rate is a major, if not the key fundamental factor in determining the actual value of your money. The actual net worth of your dollars can be translated into how much purchasing power your dollars have for buying various goods and services over time.

The rate of inflation in the United States has been steadily rising. The inflationary rate is a major, if not the key fundamental factor in determining the actual value of your money. The actual net worth of your dollars can be translated into how much purchasing power your dollars have for buying various goods and services over time....

The rate of inflation in the United States has been steadily rising. The inflationary rate is a major, if not the key fundamental factor in determining the actual value of your money. The actual net worth of your dollars can be translated into how much purchasing power your dollars have for buying various goods and services over time....

Labels:

crisis,

currency,

dollar,

gold,

hard money,

inflation,

money,

money supply,

silver,

silver coin,

true value,

united states,

us dollar,

us dollar crisis

|

0

comments

Sunday, July 1, 2012

Hyperinflation – It’s Causes & Affects

Inflation is defined as an increase in the overall level of prices for goods and services in an economy over a period of time. Thus as the prices of goods and services increase each unit of currency actually buys less, therefore decreasing the purchasing power of the money.

Hyperinflation therefore is defined as a very high rate of inflation or inflation that has gone “out of control”. During a hyperinflationary event price levels within a specific economy rise very quickly as a function of its domestic currency in contrast to a foreign currency losing its real value at an ever increasing rate....

Hyperinflation therefore is defined as a very high rate of inflation or inflation that has gone “out of control”. During a hyperinflationary event price levels within a specific economy rise very quickly as a function of its domestic currency in contrast to a foreign currency losing its real value at an ever increasing rate....

Sunday, June 24, 2012

Tax Liabilities On Precious Metal Investments

For those just starting out investing or thinking about investing in precious metals you should be aware of the IRS guidelines on reportable sales to the IRS from a precious metals dealer. So let’s just get to it. Here is what I have found out about precious metals and taxes.

For those just starting out investing or thinking about investing in precious metals you should be aware of the IRS guidelines on reportable sales to the IRS from a precious metals dealer. So let’s just get to it. Here is what I have found out about precious metals and taxes.First off, currently if you buy precious metals from a dealer within the United States they are not required to report sales transactions to the IRS. When purchasing physical gold or silver in bullion, bars, coins, or rounds. These are the most common forms of gold and silver bought for investing purposes. However when you go back to any dealer to sell your precious metals, there are certain types of transactions that are required by US law to be reported back to the IRS. This means the dealer will be sending you an IRS form 1099-B reporting the sale of your transaction and a copy of that 1099-B will go to the Internal Revenue Service....

Labels:

capital gains,

coins,

gold,

gold eagle,

irs,

precious metal,

precious metals,

silver,

silver eagle,

tax liabilities

|

0

comments

Saturday, June 16, 2012

The History Of Money

In the earliest of times trading and bartering were used in the exchange of goods and services. The trading of such items as herd animals, sea shells, salt, tobacco, gold, gemstones and other similar items were commonly used by man before actual currency was invented.

In the earliest of times trading and bartering were used in the exchange of goods and services. The trading of such items as herd animals, sea shells, salt, tobacco, gold, gemstones and other similar items were commonly used by man before actual currency was invented.Currency – The Beginning

The first currency ever used, was in coin form and dates back to 600 B.C. by then King Croesus of Lydia in Asia Minor. At that time Lydia was located in what is now present day Turkey. These coins were minted from a naturally occurring alloy of gold and silver called electrum. And each coin had a specific weight of 4.7 grams. These coins functioned as a medium of exchange, unit of payment and were capable of preserving value...

Saturday, June 9, 2012

The US Dollar and Euro vs. Gold and Silver

Gold does not have very many industrial applications or everyday uses in general. However the one thing gold has always been good for, is value protection. Throughout history gold has always maintained its true value regardless, the economic circumstances it encounters. Currency devaluation is always accompanied by inflationary monetary policy.

Gold does not have very many industrial applications or everyday uses in general. However the one thing gold has always been good for, is value protection. Throughout history gold has always maintained its true value regardless, the economic circumstances it encounters. Currency devaluation is always accompanied by inflationary monetary policy. Gold has always been used as a hedge against devaluing currencies including the US dollar. Silver has always had a high industrial demand. However now it is also being used to hedge inflation being dubbed the “poor man’s gold”....

Saturday, June 2, 2012

United States Debt & The Dollar Crisis

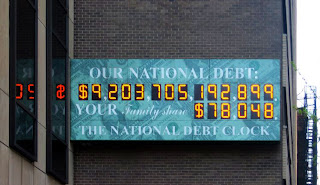

The United States is in the throes of crushing debt, politicians are not doing a good job at all reducing the amount money the government is spending and the national debt only increases day by day.

Increasingly, the unhealthy growth of the American Government borrowing dollars and spending even more dollars has only helped fuel the fire which has been creating instability for the US dollar through increased debt. However, there are other reasons for the occurrence of our current crisis and why the US dollar has been noticed “tanking” by many financial experts. All of the reasons, they said, are actually caused by both the government and the central bank itself...

Increasingly, the unhealthy growth of the American Government borrowing dollars and spending even more dollars has only helped fuel the fire which has been creating instability for the US dollar through increased debt. However, there are other reasons for the occurrence of our current crisis and why the US dollar has been noticed “tanking” by many financial experts. All of the reasons, they said, are actually caused by both the government and the central bank itself...

Sunday, May 27, 2012

Can Precious Metals Be Held In An IRA Account?

Good News you can fund your IRA’s with gold and silver. The US Government allows purchases of certain types of precious metals to be held in IRA accounts. However there are certain requirements that must be met. Also needed are special IRA account administrators who specialize in precious metals held in IRA’s and understand all the IRS rules on this form of investment.

Precious Metal Investments allowed to be held in an IRA account include:

• Physical metals

• Certificates of precious metals

• Exchange traded funds (ETF’s)

• Closed end funds (CEF’s)

• Private funds

Everything you need to know about...

Precious Metal Investments allowed to be held in an IRA account include:

• Physical metals

• Certificates of precious metals

• Exchange traded funds (ETF’s)

• Closed end funds (CEF’s)

• Private funds

Everything you need to know about...

Sunday, May 20, 2012

Sovereign Debt Problems – United States or Europe, Who Is Worse Off?

Recently Standard and Poor’s downgraded 9 European Countries including the number two EU member France. For now, it seems the number one EU economy Germany is off the hook. There are six Euro-zone Countries that currently have equal or greater debt to GDP ratios than the United States. Greece and Italy currently have higher GDP ratios while Ireland and Portugal are just about the same as the US. Currently the United States is at 100% Debt to GDP.

A big problem for America is that the financial analysts who do all the reporting on the United States debt and calculate all the financial data, only look at parts of the fiscal equation to render their reports. They mostly only factor in debt where the US borrowed money, where the Federal Government has sold Treasury Bonds. Financial analysts don’t factor in other important government debts or obligations. Such as $6 trillion in loan obligations from Fanny Mae and Freddie Mac, which are guaranteed by the Government. Or over $1 trillion in student loans again guaranteed by the Federal Government. The US is required to pay on these loans in the case of default....

A big problem for America is that the financial analysts who do all the reporting on the United States debt and calculate all the financial data, only look at parts of the fiscal equation to render their reports. They mostly only factor in debt where the US borrowed money, where the Federal Government has sold Treasury Bonds. Financial analysts don’t factor in other important government debts or obligations. Such as $6 trillion in loan obligations from Fanny Mae and Freddie Mac, which are guaranteed by the Government. Or over $1 trillion in student loans again guaranteed by the Federal Government. The US is required to pay on these loans in the case of default....

Saturday, May 12, 2012

Housing Debt - Should You Stay or Go?

The housing market has become a financial nightmare for many average people throughout the United States and in other countries today. Those who have been able to keep their homes and not lose them to the banks by way of loan defaults or foreclosures are very fortunate.

Real-estate in the United States over the past 60 months has continually seen housing prices fall. Their current values now are less than (some far lower than) what is currently owed on their mortgages. This is true in many areas of the US with few geographical exceptions. As inflation increases, expect the value of your home to decrease even more. The value of your home is expected to lose an additional 5-8% in 2012 alone. This also is absolutely not the time to go buy a new or used home, once inflation reaches around 20% most likely you will see a total collapse in the real estate market. A large number of Americans now believe that a second “Great Depression” is very possible within a few years....

Real-estate in the United States over the past 60 months has continually seen housing prices fall. Their current values now are less than (some far lower than) what is currently owed on their mortgages. This is true in many areas of the US with few geographical exceptions. As inflation increases, expect the value of your home to decrease even more. The value of your home is expected to lose an additional 5-8% in 2012 alone. This also is absolutely not the time to go buy a new or used home, once inflation reaches around 20% most likely you will see a total collapse in the real estate market. A large number of Americans now believe that a second “Great Depression” is very possible within a few years....

Sunday, May 6, 2012

American Debt - Crisis Point!

It’s all over the news these days the American Debt Crisis. Will the Democrats, Republicans & Obama ever agree to raise the debt ceiling in time before the US goes into default on paying its own debt? What will happen?

Currently many Americans now have to actually use their credit cards just to buy food for their families and fuel for their cars. Their incomes are not enough anymore to cover these most basic monthly expenses due to ever growing costs through inflation. America’s Debt to GDP ratio is now over 100% with an official $15.3 trillion overall national debt. However in truth you’re not really seeing the bigger picture. ...

Currently many Americans now have to actually use their credit cards just to buy food for their families and fuel for their cars. Their incomes are not enough anymore to cover these most basic monthly expenses due to ever growing costs through inflation. America’s Debt to GDP ratio is now over 100% with an official $15.3 trillion overall national debt. However in truth you’re not really seeing the bigger picture. ...

Sunday, April 29, 2012

Euro Zone Crisis – Will It Destroy The US Dollar?

The economic conditions in Europe are becoming worse as the weeks move on. In all, there’s at least a fifty percent stake involving US banks that are exposed to some degree with European debt problems within the Euro-zone. Furthermore, it is the US dollar that still remains the world’s reserve currency. And the Federal Reserve, whose status remains none other than the “lender of last resort” thus, making it very hazardous for the US taxpayers.

The huge US Government bailout program from 2008 only helped the large banks, auto industry and giant institutions such as AIG and several foreign central banks from going under. Because they were all deemed “to big to fail” at the end of the day however, nothing was solved and the bailouts amounted to nothing. These mega banks and companies only lined their own greedy corporate pockets and left the American taxpayers holding the bag...

The huge US Government bailout program from 2008 only helped the large banks, auto industry and giant institutions such as AIG and several foreign central banks from going under. Because they were all deemed “to big to fail” at the end of the day however, nothing was solved and the bailouts amounted to nothing. These mega banks and companies only lined their own greedy corporate pockets and left the American taxpayers holding the bag...

Sunday, April 22, 2012

The End of the Dollar - Is Heading Towards Us

There is no mistaking it as the world’s largest economy is still bleeding out from the 2007 financial crisis. In spite of the governments questionable attempts to intervene and add buoyancy to the sinking ship “America” foreclosures are still at all time highs, unemployment is way too high and the national debt is over $15 trillion dollars.

Furthermore countries across the planet want out of financing our debt. Their now dumping dollars as fast as possible and either buying gold or other national debt. The overinflating of the US money supply thru QE-1 and QE-2 have caused great concern to countries like China who are now pleading to the US Government to stop inflating the currency as there still holding about 1.3 trillion dollars in their Central Bank...

Furthermore countries across the planet want out of financing our debt. Their now dumping dollars as fast as possible and either buying gold or other national debt. The overinflating of the US money supply thru QE-1 and QE-2 have caused great concern to countries like China who are now pleading to the US Government to stop inflating the currency as there still holding about 1.3 trillion dollars in their Central Bank...

Sunday, April 15, 2012

Fed Up With The Fed? – Well You Should Be!

The Federal Reserve Act became law on December 23, 1913 by President Woodrow Wilson after the law was voted in by Congress. There were 12 central banks set up by the Federal Reserve situated across America. These banks formed a nationwide system used to enable assistance in the event crises were to develop in the future, within the American financial system.

During the Great Depression the single largest mistake made in recovery efforts was calling in substantial amounts of the currency by the Federal Reserve. The backlash from lack of available funds caused massive business shutdowns which resulted in massive unemployment across America...

During the Great Depression the single largest mistake made in recovery efforts was calling in substantial amounts of the currency by the Federal Reserve. The backlash from lack of available funds caused massive business shutdowns which resulted in massive unemployment across America...

Tuesday, April 10, 2012

QE-3 Is On Its Way – Make No Mistake About It!

Of all the various indexes out there the one were looking at here is referred to as the "Misery" index. Yes this is its actual name. The sum of the unemployment rate plus the rate of consumer price inflation equals the misery index. This index is now close to its all-time high. There are several major factors that are affecting its increase.

First off the ECB steadily giving into monetizing the majority of Europe’s debt. Next, The Bank of England recently passed a measure to monetize an additional 75 billion British pounds. They expect this will help ease their problems and of course will only make matters worse. The newest, we have comments coming from Helicopter Ben’s own minions Fed Governor Dan Tarullo that recently gave this statement. “I believe we should move back up toward the top of the list of options the large scale purchase of additional MBS” (Mortgage Backed Securities)...

First off the ECB steadily giving into monetizing the majority of Europe’s debt. Next, The Bank of England recently passed a measure to monetize an additional 75 billion British pounds. They expect this will help ease their problems and of course will only make matters worse. The newest, we have comments coming from Helicopter Ben’s own minions Fed Governor Dan Tarullo that recently gave this statement. “I believe we should move back up toward the top of the list of options the large scale purchase of additional MBS” (Mortgage Backed Securities)...

Friday, March 30, 2012

Investing in Physical Silver

Investing in physical silver, i.e. silver coin or bullion that you can actually see and feel in your own hands is a great investment. Opposed to paper silver such as silver stocks or ETF’s which are not a very good investment due to higher risks involved rather than owning the precious metal itself.

Along with its big brother gold, silver is extremely effective in maintaining a hedge against inflation by withstanding any severe economic or government crisis. Silver just as gold will always seek its true value insuring that your wealth will be protected in the event a severe economic crisis does occur...

Along with its big brother gold, silver is extremely effective in maintaining a hedge against inflation by withstanding any severe economic or government crisis. Silver just as gold will always seek its true value insuring that your wealth will be protected in the event a severe economic crisis does occur...

Saturday, March 24, 2012

Inflation and the Economic Crisis

If you happen to be an American reading this article then I assure you that you’re in the midst of the greatest financial paradigm shift in modern history. Furthermore you have a front row seat to this epic event. Hopefully you are one of the few that have been following this event closely and paying attention to options still available to you for protecting yourself from rising inflation, and the ever approaching economic crisis.

Hopefully, you’re not in the category of non believers thinking the government will save you. Doing your best pretending the day of reckoning is never going to come upon your doorstep, regardless of all the evidence you might have heard or read about. Regardless what level of defiance you carry around with you history will always be on the side of the truth. There is no prejudice here that will enter the equation regardless of what you think you would be entitled to. If I am sounding a little pessimistic, then I am making my point. There is nothing that will keep this economic crisis from coming and there is too much hard evidence and monetary history surrounding this to look the other way...

Hopefully, you’re not in the category of non believers thinking the government will save you. Doing your best pretending the day of reckoning is never going to come upon your doorstep, regardless of all the evidence you might have heard or read about. Regardless what level of defiance you carry around with you history will always be on the side of the truth. There is no prejudice here that will enter the equation regardless of what you think you would be entitled to. If I am sounding a little pessimistic, then I am making my point. There is nothing that will keep this economic crisis from coming and there is too much hard evidence and monetary history surrounding this to look the other way...

Saturday, March 17, 2012

The Truth Be Told About The Dollar And Gold

I’m here today to share a secret that I exposed, which seems to keep missing out on the nightly news broadcasts. I don’t know why this information has not been at the center of media attention but it should have been in mainstream news several years ago.

For a quite a while now lots of attention has been given in the media regarding the higher costs of living such new state taxes, staple consumer goods, fuel etc. Also for those paying attention you will have seen and heard lot s of information in the news on increasing gold prices. Main stream media has been covering the economy saying all the while it is improving.

However all one needs to do is open their eyes and look to see that many businesses are struggling and shutting down. Is this improvement? We can listen to people telling how they don't have any savings left or money anymore. It’s only obvious the US Economy is getting worse. The value of the US Dollar which has also solely been used as the world’s reserve currency is faltering. Consequently most world currencies are failing along with it. Question: Why is all this happening? What can anyone do?...

For a quite a while now lots of attention has been given in the media regarding the higher costs of living such new state taxes, staple consumer goods, fuel etc. Also for those paying attention you will have seen and heard lot s of information in the news on increasing gold prices. Main stream media has been covering the economy saying all the while it is improving.

However all one needs to do is open their eyes and look to see that many businesses are struggling and shutting down. Is this improvement? We can listen to people telling how they don't have any savings left or money anymore. It’s only obvious the US Economy is getting worse. The value of the US Dollar which has also solely been used as the world’s reserve currency is faltering. Consequently most world currencies are failing along with it. Question: Why is all this happening? What can anyone do?...

Friday, March 9, 2012

Re-Examining - The Gold Standard

A sound monetary system is one in which a currency is backed by gold, at least a percentage or fixed weight of gold. This is different from the monetary system currently used in the United States and many other countries. Today, all national currencies are fiat currencies. Fiat currency is currency that has value only because of government regulation or law of which carries no intrinsic value of any kind.

At the time of the Great Depression, numerous countries went away from the gold standard since they had to pump money into their economies to stimulate growth. Having a gold standard would not allow them adequate economic flexibility. It is also true that there can actually be too much economic flexibility...

At the time of the Great Depression, numerous countries went away from the gold standard since they had to pump money into their economies to stimulate growth. Having a gold standard would not allow them adequate economic flexibility. It is also true that there can actually be too much economic flexibility...

Saturday, March 3, 2012

FCIC Puts Blame Onto Banks And Government For Financial Crisis

The 2007 financial disaster has adversely changed the lives of countless numbers of Americans. Many asking the question, who is to blame for creating this crisis?

A recent study make known by the Financial Crisis Inquiry Commission (FCIC) places the blame on government and the banks as the two main criminal’s envolved in the stock market crash and resulting financial chaos. The report shows that the deregulation and self-regulation by the banks are major factors. The report continues saying banks not only overlooked warnings they also failed to properly manage and put into question the risks that their faulty mortgages were giving out...

Friday, February 24, 2012

Blame For The Financial Crisis is On The Fed - But Paulson & Soros Take The Heat

A lot of people put the blame in several directions while looking for answers in our latest financial crisis. For the most part all evidence has been focused towards the Federal Reserve. Accused of creating this crisis by severe lack of oversight.

The Fed jumped on the bandwagon with their own list of people who created this George Soros of Soros Fund Management LLC, and John Paulson of Paulson & Co. trying to take the attention away from themselves. Back in 2007 Paulson & Co. bet against sub primes and cashed in on 15 Billon in profits when the crash hit. Paulson commented that greater oversight should have been done on the home loans, which very well could have avoided the crisis.

However at the time sub primes were in their heyday the Federal Reserve decided to take a hands off approach. Meanwhile Soros blamed the Federal Reserve saying they should have stepped in and saved Lehman Brothers in 2008 from their collapse. The Financial Crisis Inquiry Commission (FCIC) had interviews both Soros & Paulson during their investigations for making their official report...

Labels:

asset protection,

debt,

federal reserve,

fiat currencies,

financial crisis,

george soros,

paulson,

soros,

subprimes,

the fed

|

0

comments

Friday, February 10, 2012

Riots In The UK Coming to America? Well The US Is Ready!

The recent uprising towards the British Government involving massive rioting in the UK just adds to anti-government sediment within America. The United States still is not able get their fiscal house in order, Unemployment is very high and there is little to no hope for the middle and lower class to get ahead because only the rich will get richer.

Sadly the American Government just keeps running around in circles with no permanent fix in sight. Instead of attacking the root problem head on. Of all businesses, it is Amazon UK that seems to be telling us what is in store for the near future in the realm of civil unrest. For in the UK on August 9th Amazon saw record sales in their “sports and leisure” category. This information seemed highly worrisome to many when the news came out. The reason being many of the products sold could double as weapons. Items such as solid wooden and aluminum baseball bats, and telescoping police batons or “Tonfas” & night sticks...

Sadly the American Government just keeps running around in circles with no permanent fix in sight. Instead of attacking the root problem head on. Of all businesses, it is Amazon UK that seems to be telling us what is in store for the near future in the realm of civil unrest. For in the UK on August 9th Amazon saw record sales in their “sports and leisure” category. This information seemed highly worrisome to many when the news came out. The reason being many of the products sold could double as weapons. Items such as solid wooden and aluminum baseball bats, and telescoping police batons or “Tonfas” & night sticks...

Saturday, February 4, 2012

US. Now At Their $14.3 Trillion Debt Limit: Enough Is Enough!

The United States has exceeded the federal debt limit. The Government now has to shuffle money around. Important investments have been halted until mutual agreement over the debt limit can be resolved. The US. has until August 2nd to come up with a mutual plan to raise the debt limit.

Everyone is in agreement that the debt limit must be raised. Only problem is so far the President, Republicans and Democrats can’t see eye to eye on the solution. Let’s hope they find one fast. The head of the Federal Reserve Bank, Ben Bernanke, and the US Secretary of the Treasury, Timothy Geithner, have warned that without a debt limit extension an extremely serious large financial crisis will be expected soon. There are only a couple months to go at that time the US would be forced into defaulting on their immense national and foreign debts. The outcome would severely cripple the US dollar and the US economy while many other foreign economies also will feel the pain...

Labels:

debt limit,

deflation,

federal reserve,

hyperinflation,

qe2

|

0

comments

Saturday, January 21, 2012

The Steadily Declining Dollar

Today there are some serious inflationary issues facing the US economy. We believe the dollar will soon come under severe pressure possibly within the next year. This brings us to the question: why has the US. Government let the value of the US. Dollar fall so much?

In response this question we will need to take a look back into history. Since 1944, following the well-known summit of the global central bankers at Bretton Woods, New Hampshire it was determined that the US. Dollar would become the world's reserve currency...

Subscribe to:

Posts (Atom)

About Me

- Unknown

Join Our Newsletter

Subscribe to our Free Newsletter, fill out the form below. Watch for our weekly newsletter updates.

Our strict privacy policy keeps your email address 100% safe & secure.

Powered by Blogger.