Showing posts with label central bank. Show all posts

Showing posts with label central bank. Show all posts

Sunday, May 19, 2013

American Debt and Its Consequences

The US dollar being the world’s reserve currency where other central banks have taken comfort for decades, now is fundamentally broke. The world’s reserve currency is now broke because of the accumulated American debt that can no longer be controlled.

The US dollar being the world’s reserve currency where other central banks have taken comfort for decades, now is fundamentally broke. The world’s reserve currency is now broke because of the accumulated American debt that can no longer be controlled.These days the politicians elected into government and tasked with responsible policy making, don't have the political will do right thing. They refuse to turn things around, to stop the slow train wreck that's approaching. Some believe this slow train wreck will arrive sometime around 2015. This train has been built upon the tracks of circumstance, with decisions that were created re-actively, thus now it's running out of control…

Saturday, April 27, 2013

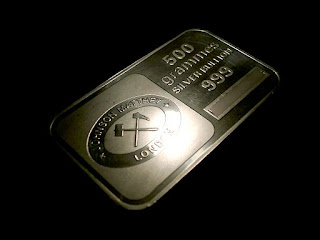

Why Investing in Silver is Better Than Gold

95 percent of all the gold ever mined is still in existence today in one form or another. On the other hand 95 percent or more of the silver that has ever been mined to date, has either been used or destroyed in small quantities, for many industrial and technological applications. So the majority of it is gone forever.

95 percent of all the gold ever mined is still in existence today in one form or another. On the other hand 95 percent or more of the silver that has ever been mined to date, has either been used or destroyed in small quantities, for many industrial and technological applications. So the majority of it is gone forever.While the élite and the central bank’s own tons of gold bullion, it's interesting to note that they hold no physical silver. Physical silver is cheaper than physical gold. Therefore the average person could without much thought, buy an ounce or two at any time without hurting their wallets or upsetting their budgets. On the other hand…

Saturday, March 2, 2013

Assessing The Impact - On Gold Purchases, For Central Banks

The latest analysis involving of central bank reserve managers shows a major modification within their “official” reserve holdings. It appears this major modification extends well into the next decade. The change is a deliberate increase of gold accumulation within the holdings of central banks.

The latest analysis involving of central bank reserve managers shows a major modification within their “official” reserve holdings. It appears this major modification extends well into the next decade. The change is a deliberate increase of gold accumulation within the holdings of central banks.Currently were already seeing central banks acquiring larger amounts of gold bullion. Gold bullion reserves that were reported have surpassed 439.7 tons last year. This is seen as the largest annual increase in nearly 50 years, which does not include any major un-reported purchases during this time. It is well-known that many central banks have snapped up tonnage when market prices are at near bottoms on market corrections...

Friday, January 11, 2013

Gold Theft & Manipulation - Through Central Bank Leasing

There has been a huge cover-up in the price of gold. This price suppression has been going on for years. Central banks have been at the center of this manipulation and the evidence can be found in the commodities and future trading commission reports. Mr. Theodore Butler with due diligence is the main person responsible for following the long chain of events that finally led to the discovery of these price manipulations and cover-ups by central bankers for years.

Legal Practice of Leasing Out Precious Metals

Before the central banks entered into this leasing game, the leasing or swapping of precious metals from one mine to another was used when production for whatever reason was stopped. Because mines sell future contracts during production, during a shutdown they would be on the hook for…

Legal Practice of Leasing Out Precious Metals

Before the central banks entered into this leasing game, the leasing or swapping of precious metals from one mine to another was used when production for whatever reason was stopped. Because mines sell future contracts during production, during a shutdown they would be on the hook for…

Saturday, September 8, 2012

Inflation, Central Banks Control & The Cure!

Inflation is a serious problem that will affect any society overtime. Serious monetary stresses are created that will affect the most basic of needs such as food for your family to eat, fuel for your car or medicine to keep you alive. Inflation makes the prices you pay increase on the exact same products or services you were buying or using before. Most people will realize these price increases as they reflect on what these items had cost them only 1-2 years ago. Why?

Inflation is created by directly increasing the money supply in an economy. When this happens it creates a watering down affect on the money supply. If you take newly created dollars and add them to the economies money supply, along with all the other dollars that were already there, we get the total money supply…

Inflation is created by directly increasing the money supply in an economy. When this happens it creates a watering down affect on the money supply. If you take newly created dollars and add them to the economies money supply, along with all the other dollars that were already there, we get the total money supply…

Subscribe to:

Posts (Atom)

About Me

- Unknown

Join Our Newsletter

Subscribe to our Free Newsletter, fill out the form below. Watch for our weekly newsletter updates.

Our strict privacy policy keeps your email address 100% safe & secure.

Powered by Blogger.