Saturday, June 16, 2012

The History Of Money

In the earliest of times trading and bartering were used in the exchange of goods and services. The trading of such items as herd animals, sea shells, salt, tobacco, gold, gemstones and other similar items were commonly used by man before actual currency was invented.

In the earliest of times trading and bartering were used in the exchange of goods and services. The trading of such items as herd animals, sea shells, salt, tobacco, gold, gemstones and other similar items were commonly used by man before actual currency was invented.Currency – The Beginning

The first currency ever used, was in coin form and dates back to 600 B.C. by then King Croesus of Lydia in Asia Minor. At that time Lydia was located in what is now present day Turkey. These coins were minted from a naturally occurring alloy of gold and silver called electrum. And each coin had a specific weight of 4.7 grams. These coins functioned as a medium of exchange, unit of payment and were capable of preserving value...

Saturday, June 9, 2012

The US Dollar and Euro vs. Gold and Silver

Gold does not have very many industrial applications or everyday uses in general. However the one thing gold has always been good for, is value protection. Throughout history gold has always maintained its true value regardless, the economic circumstances it encounters. Currency devaluation is always accompanied by inflationary monetary policy.

Gold does not have very many industrial applications or everyday uses in general. However the one thing gold has always been good for, is value protection. Throughout history gold has always maintained its true value regardless, the economic circumstances it encounters. Currency devaluation is always accompanied by inflationary monetary policy. Gold has always been used as a hedge against devaluing currencies including the US dollar. Silver has always had a high industrial demand. However now it is also being used to hedge inflation being dubbed the “poor man’s gold”....

Saturday, June 2, 2012

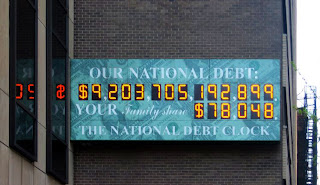

United States Debt & The Dollar Crisis

The United States is in the throes of crushing debt, politicians are not doing a good job at all reducing the amount money the government is spending and the national debt only increases day by day.

Increasingly, the unhealthy growth of the American Government borrowing dollars and spending even more dollars has only helped fuel the fire which has been creating instability for the US dollar through increased debt. However, there are other reasons for the occurrence of our current crisis and why the US dollar has been noticed “tanking” by many financial experts. All of the reasons, they said, are actually caused by both the government and the central bank itself...

Increasingly, the unhealthy growth of the American Government borrowing dollars and spending even more dollars has only helped fuel the fire which has been creating instability for the US dollar through increased debt. However, there are other reasons for the occurrence of our current crisis and why the US dollar has been noticed “tanking” by many financial experts. All of the reasons, they said, are actually caused by both the government and the central bank itself...

Sunday, May 27, 2012

Can Precious Metals Be Held In An IRA Account?

Good News you can fund your IRA’s with gold and silver. The US Government allows purchases of certain types of precious metals to be held in IRA accounts. However there are certain requirements that must be met. Also needed are special IRA account administrators who specialize in precious metals held in IRA’s and understand all the IRS rules on this form of investment.

Precious Metal Investments allowed to be held in an IRA account include:

• Physical metals

• Certificates of precious metals

• Exchange traded funds (ETF’s)

• Closed end funds (CEF’s)

• Private funds

Everything you need to know about...

Precious Metal Investments allowed to be held in an IRA account include:

• Physical metals

• Certificates of precious metals

• Exchange traded funds (ETF’s)

• Closed end funds (CEF’s)

• Private funds

Everything you need to know about...

Sunday, May 20, 2012

Sovereign Debt Problems – United States or Europe, Who Is Worse Off?

Recently Standard and Poor’s downgraded 9 European Countries including the number two EU member France. For now, it seems the number one EU economy Germany is off the hook. There are six Euro-zone Countries that currently have equal or greater debt to GDP ratios than the United States. Greece and Italy currently have higher GDP ratios while Ireland and Portugal are just about the same as the US. Currently the United States is at 100% Debt to GDP.

A big problem for America is that the financial analysts who do all the reporting on the United States debt and calculate all the financial data, only look at parts of the fiscal equation to render their reports. They mostly only factor in debt where the US borrowed money, where the Federal Government has sold Treasury Bonds. Financial analysts don’t factor in other important government debts or obligations. Such as $6 trillion in loan obligations from Fanny Mae and Freddie Mac, which are guaranteed by the Government. Or over $1 trillion in student loans again guaranteed by the Federal Government. The US is required to pay on these loans in the case of default....

A big problem for America is that the financial analysts who do all the reporting on the United States debt and calculate all the financial data, only look at parts of the fiscal equation to render their reports. They mostly only factor in debt where the US borrowed money, where the Federal Government has sold Treasury Bonds. Financial analysts don’t factor in other important government debts or obligations. Such as $6 trillion in loan obligations from Fanny Mae and Freddie Mac, which are guaranteed by the Government. Or over $1 trillion in student loans again guaranteed by the Federal Government. The US is required to pay on these loans in the case of default....

Saturday, May 12, 2012

Housing Debt - Should You Stay or Go?

The housing market has become a financial nightmare for many average people throughout the United States and in other countries today. Those who have been able to keep their homes and not lose them to the banks by way of loan defaults or foreclosures are very fortunate.

Real-estate in the United States over the past 60 months has continually seen housing prices fall. Their current values now are less than (some far lower than) what is currently owed on their mortgages. This is true in many areas of the US with few geographical exceptions. As inflation increases, expect the value of your home to decrease even more. The value of your home is expected to lose an additional 5-8% in 2012 alone. This also is absolutely not the time to go buy a new or used home, once inflation reaches around 20% most likely you will see a total collapse in the real estate market. A large number of Americans now believe that a second “Great Depression” is very possible within a few years....

Real-estate in the United States over the past 60 months has continually seen housing prices fall. Their current values now are less than (some far lower than) what is currently owed on their mortgages. This is true in many areas of the US with few geographical exceptions. As inflation increases, expect the value of your home to decrease even more. The value of your home is expected to lose an additional 5-8% in 2012 alone. This also is absolutely not the time to go buy a new or used home, once inflation reaches around 20% most likely you will see a total collapse in the real estate market. A large number of Americans now believe that a second “Great Depression” is very possible within a few years....

Sunday, May 6, 2012

American Debt - Crisis Point!

It’s all over the news these days the American Debt Crisis. Will the Democrats, Republicans & Obama ever agree to raise the debt ceiling in time before the US goes into default on paying its own debt? What will happen?

Currently many Americans now have to actually use their credit cards just to buy food for their families and fuel for their cars. Their incomes are not enough anymore to cover these most basic monthly expenses due to ever growing costs through inflation. America’s Debt to GDP ratio is now over 100% with an official $15.3 trillion overall national debt. However in truth you’re not really seeing the bigger picture. ...

Currently many Americans now have to actually use their credit cards just to buy food for their families and fuel for their cars. Their incomes are not enough anymore to cover these most basic monthly expenses due to ever growing costs through inflation. America’s Debt to GDP ratio is now over 100% with an official $15.3 trillion overall national debt. However in truth you’re not really seeing the bigger picture. ...

Subscribe to:

Posts (Atom)

About Me

- Unknown

Join Our Newsletter

Subscribe to our Free Newsletter, fill out the form below. Watch for our weekly newsletter updates.

Our strict privacy policy keeps your email address 100% safe & secure.

Powered by Blogger.